June 2024

Annual meeting highlights company’s planned investment in generation to achieve carbon reduction goals

MGE Energy shareholders joined executive leadership in May for the company’s virtual annual meeting during which Chairman, President and CEO Jeff Keebler discussed the company’s continued investment in cost-effective, carbon-free energy to achieve its science-based carbon reduction goals. The company’s utility subsidiary, Madison Gas and Electric (MGE), has a goal of net-zero carbon electricity by 2050.

“By 2030, we expect to deliver to every customer electricity with 80% fewer carbon emissions than 2005 levels. MGE already has reduced carbon emissions nearly 40% from 2005—putting the company halfway to its goal of 80% reduced emissions,” Keebler said from the company’s headquarters in downtown Madison. “MGE is greening our grid cost-effectively on behalf of all customers while working with them on the demand side to advance energy efficiency and the electrification of transportation.

"While we cannot pursue these strategies for them, we can provide—and are providing—programs and services that support our customers as they electrify and become increasingly more energy efficient,” Keebler added.

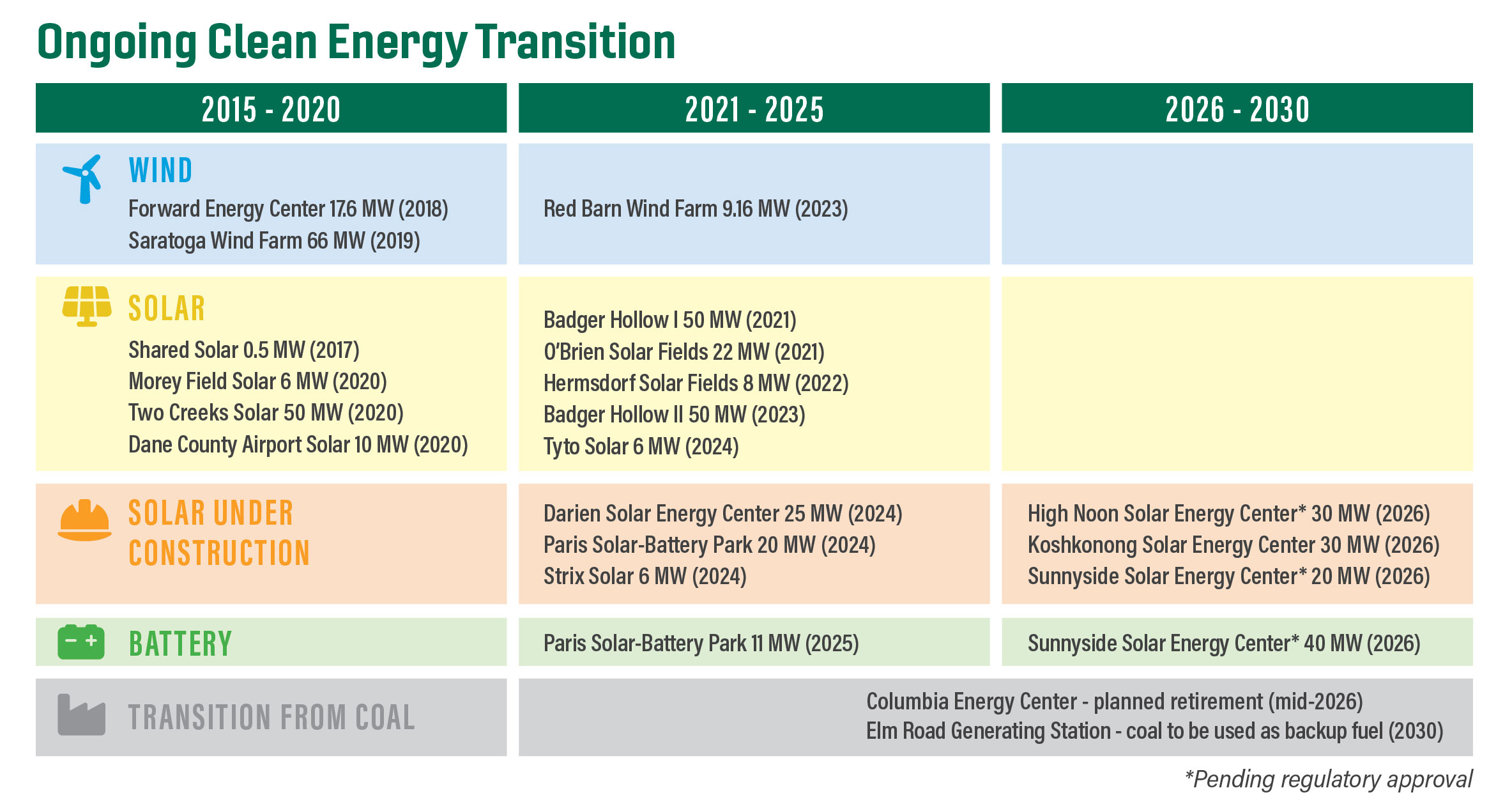

MGE also continues its transition away from coal-fired generation. By the end of 2026, with the planned retirement of both units at the Columbia Energy Center, MGE will have eliminated approximately two-thirds of the company’s current coal-fired generation capacity.

Last fall, the Columbia Energy Storage Project was selected for a grant from the U.S. Department of Energy. The grant supports the construction of a compressed carbon dioxide long-duration energy storage system at the site of the Columbia plant. MGE is a partner on the project with the plant’s co-owners who are expected to seek State regulatory approval for the innovative system this year.

The company’s remaining use of coal is expected to be reduced further as the Elm Road Generating Station transitions to natural gas. By the end of 2030, MGE expects coal to be used only as a backup fuel at the Elm Road plant. The company expects to have zero ownership of coal-fired generation by the end of 2032.

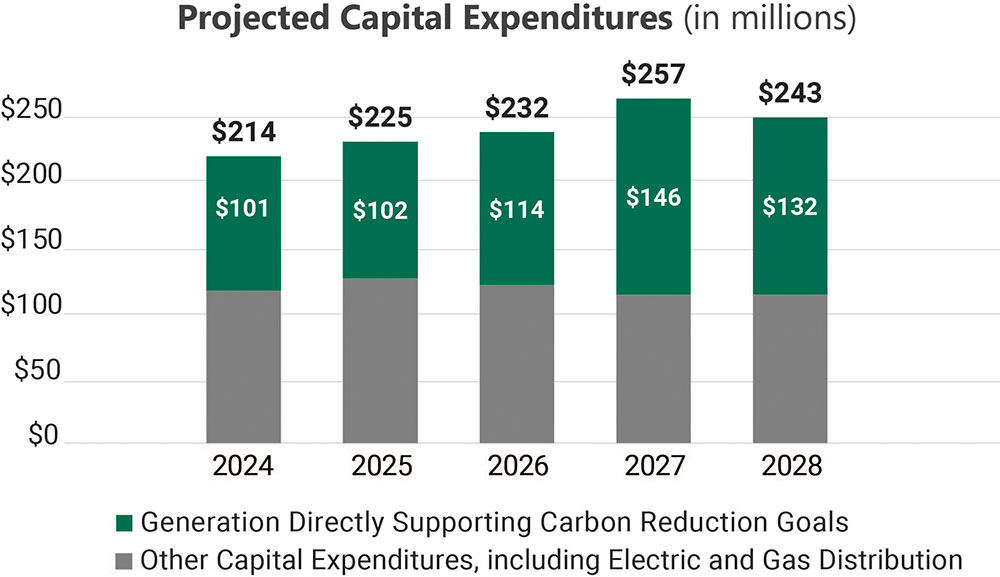

Jared Bushek, Vice President Chief Financial Officer and Treasurer, said the current forecast for capital expenditures represents the company’s largest five-year plan for electric generation in its history.

“Approximately a billion dollars of investment in clean energy and battery storage is expected from 2015, when MGE announced its Energy 2030 framework, through 2028. Approximately 20% is local investment in the company’s service territory—existing and planned projects,” Bushek said.

MGE is transitioning its energy supply while maintaining service reliability and energy affordability. Bushek said the planned addition of battery storage and dispatchable generation, such as highly efficient natural gas, will help enable MGE’s clean energy transition and help maintain its top-ranked electric reliability.

Keebler concluded his remarks by saying the issue of affordability and energy burden is something the company takes seriously as your community energy company and as a regulated utility.

“A regulated utility has an obligation to serve all customers with transparency and accountability,” he said. “MGE, as a regulated utility, is delivering to ensure all our diverse customers benefit, delivering a safe and resilient and increasingly cleaner grid that provides affordable energy and ongoing value as we work together toward our goals.”

For more from the 2024 Annual Meeting, watch the webcast.

MGE Energy welcomes new directors to the board

In March, the Board of Directors welcomed three new independent directors who were elected by the board in December 2023. All were elected by the board at that time to serve on the Audit and the Corporate Governance committees.

Patricia Ackerman

A Class II director, Patricia Ackerman was up for election at this year’s annual meeting and was voted by shareholders to serve a three-year term expiring at the Annual Meeting in 2027. Ms. Ackerman was Senior Vice President, Investor Relations, Corporate Responsibility and Sustainability, and Treasurer at A.O. Smith, a global water heater and boiler manufacturing company, prior to her retirement in March 2022. She also served as the management representative for A.O. Smith’s Audit Committee and ESG advisor to the board. Ms. Ackerman holds a Bachelor of Business in Finance from the University of Wisconsin-Madison and an MBA from Marquette University.

Daniel Kelly

A Class III director, Daniel Kelly served as Chief Underwriting Officer of American Family Insurance before retiring in late 2023. Mr. Kelly served in various roles at American Family, including in Financial Analysis, Accounting, Operations and Human Resources. He also served as the company’s Chief Financial Officer beginning in 2011. Mr. Kelly received his bachelor’s degree in business administration and MBA from the University of Wisconsin-Madison. He also is a certified public accountant. His term expires in 2025.

Angela Rieger

A Class I director, Angela Rieger is Executive Vice President, Chief Transformation Officer at Lands’ End, a clothing and home décor retailer, where she is responsible for all aspects of the product life cycle, from initial development through final sales. Previously, she held several advanced leadership roles at Lands’ End. Ms. Rieger holds a Bachelor of Science in business administration and organization development from the University of Illinois. Her term expires in 2026.

Find full biographical information in this year’s proxy.

Historic investment in cleaner generation planned

This spring, Madison Gas and Electric (MGE) filed for State regulatory approval to build the Sunnyside Solar Energy Center, a 20-megawatt (MW) solar array and 40-MW battery storage system in Fitchburg, Wisconsin. If approved, the approximately $110 million project will provide locally generated solar energy and battery storage capacity to MGE’s distribution system.

The proposed project is part of approximately a billion dollars in clean energy and battery storage investment from 2015 through 2028. Approximately 20% of the company’s billion dollars in current and planned investment is in MGE’s service territory.

That includes MGE’s 6-MW Strix Solar project, currently under construction in Fitchburg. One-third of the project, which is expected online by the end of this year, is expected to serve the company’s proposed Shared Solar II program (see article below).

Near the Strix Solar project is MGE’s Tyto Solar, which came online in early 2024. The 6-MW project is directly connected to MGE’s distribution grid to serve all MGE customers with local, carbon-free energy.

Under construction

MGE expects two other solar projects to come online this year. The company will own a 10% share of each when completed.

Paris Solar-Battery Park: MGE will own 20 MW of solar energy and 11 MW of battery storage from the 200-MW solar and 110-MW battery storage facility under construction in Kenosha County, Wisconsin. The solar is expected online in 2024; the battery storage is expected online in 2025.

Darien Solar Energy Center: MGE will own 25 MW of solar energy from the 250-MW solar facility under construction in Rock and Walworth counties in southern Wisconsin.

Proposed purchase

In early February, MGE filed an application with State regulators to purchase a share of the High Noon Solar Energy Center. The 300-MW solar array will be located in Columbia County.

If the purchase is approved, MGE will own 30 MW of solar. The High Noon Solar Energy Center is expected to start serving customers by the end of 2026.

Asset growth

The company’s investment in cost-effective renewable generation is helping fuel asset growth. In the last five years, MGE Energy has grown its asset base from nearly $2 billion to almost $2.7 billion, resulting in a compound annual growth rate in assets of 6%.

In 2023, the 92-MW Red Barn Wind Farm and the second 150-MW phase of the Badger Hollow Solar Farm began serving customers. MGE owns a share of both facilities, which will help meet the company’s capacity needs as it prepares for the retirement of the Columbia Energy Center in mid-2026. The company expects additional clean energy investment beyond what is currently planned.

MGE proposes new community solar option for customers

Madison Gas and Electric (MGE) proposed in early April a new community solar program largely based on Shared Solar, MGE’s original and fully subscribed community solar program. The proposal offers participants the option to pay a minimal up-front fee to subscribe to receive energy from Strix Solar, currently under construction in Fitchburg, for six years as the company continues to work toward reduced carbon emissions of at least 80% by 2030 (based on 2005 levels).

“Shared Solar II builds on the success of our popular community solar program and provides our customers with another option for affordable, locally generated, carbon-free energy while also reducing costs for nonparticipating customers,” said Jeff Keebler, MGE Chairman, President and CEO. “Our Shared Solar II program also includes a proposal for a participation option for eligible low-income customers.”

If State regulators approve the program, MGE residential and small business electric customers who choose to participate in Shared Solar II could receive carbon-free energy for up to 50% of their annual consumption and would lock in their energy rate for the six-year term of the agreement. Participating customers would pay a minimal up-front participation fee based on the number of shares they select.

A low-income alternative also is proposed for Shared Solar II. Under the proposed low-income option, eligible customers would pay a smaller up-front participation fee to reserve shares and a lower fixed energy rate to participate. Eligible customers could include those who receive energy assistance from the Wisconsin Home Energy Assistance Program, the Keep Wisconsin Warm/Cool Fund, the MGE Energy Fund, housing-related funding or other sources.

Renewable natural gas option for customers

MGE is offering a new sustainable energy option for its natural gas customers. The company’s Green Power Tomorrow (GPT) renewable natural gas (RNG) option, known as GPT RNG, is a way for customers to reduce their footprint by offsetting their greenhouse gas emissions from their use of natural gas. MGE is the first utility in the state to offer this type of RNG option to customers.

RNG is a processed biogas derived from organic waste material, such as food waste, yard and crop waste, and animal waste. It also can be produced from degradable carbon sources like paper, cardboard and wood. RNG is carbon-neutral because it comes from the natural breakdown of organic sources instead of from fossil fuels.

Under the GPT RNG option, customers pay an incremental charge to participate. MGE purchases Renewable Thermal Certificates (RTCs) on behalf of the customer to offset the emissions associated with the customer’s monthly usage. Customers may select a set number of therms each month to offset through GPT RNG or a percentage of their monthly usage. MGE then purchases RTCs on the customer’s behalf, offsetting the emissions associated with the customer’s use of natural gas.

This new program option is another way in which MGE is building upon its long-standing commitment to providing safe, reliable, affordable and sustainable energy. MGE has set a goal to achieve net-zero methane emissions from its natural gas distribution system by 2035.

Learn more about our strategies.