May 2022

Technology in Action

Clean energy transition fueling capital expenditures, asset growth

In early 2022, our regulated utility, Madison Gas and Electric (MGE), committed to reducing carbon emissions at least 80% by 2030 as it works toward net-zero carbon by mid-century. MGE was one of the first utilities in the nation to establish a goal of net-zero carbon electricity in 2019. To achieve its industry-leading carbon reduction goals, MGE is growing its use of cost-effective, clean energy and working to decarbonize its electricity generation.

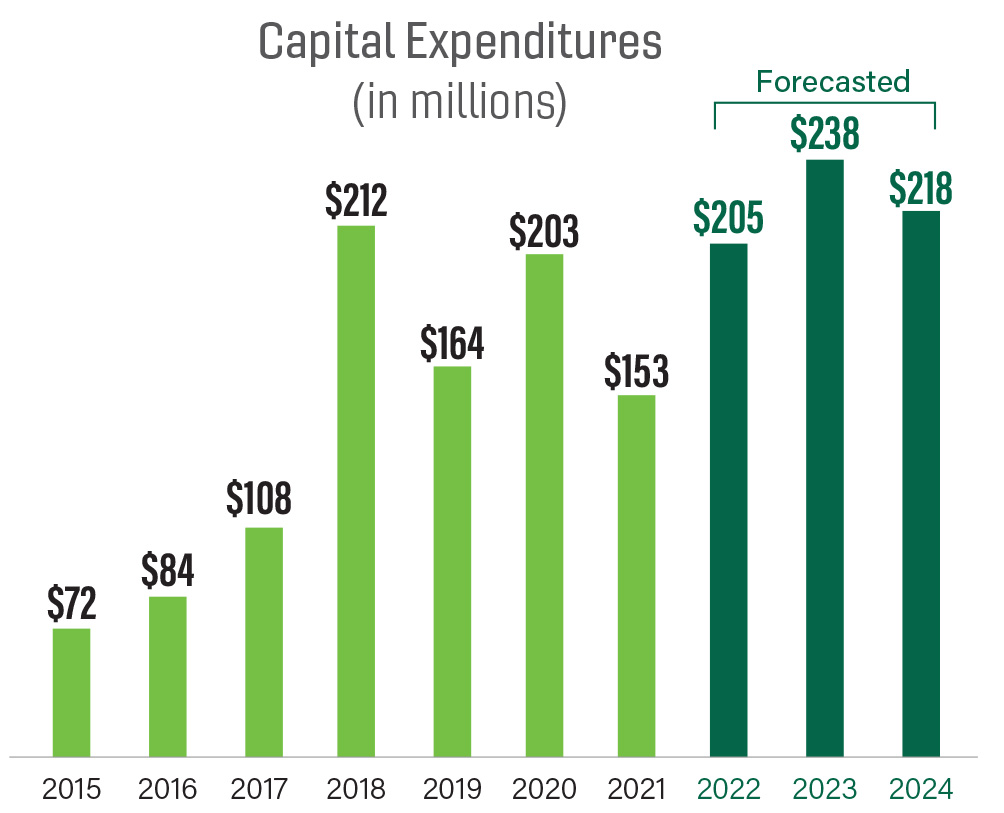

The company’s commitment to sustainable energy is reflected in its investment strategy. Since introducing its Energy 2030 framework in November 2015, nearly half of its estimated capital expenditures through 2024 support clean energy. An estimated $645 million in renewable energy generation and battery storage will help advance the company’s decarbonization and financial goals.

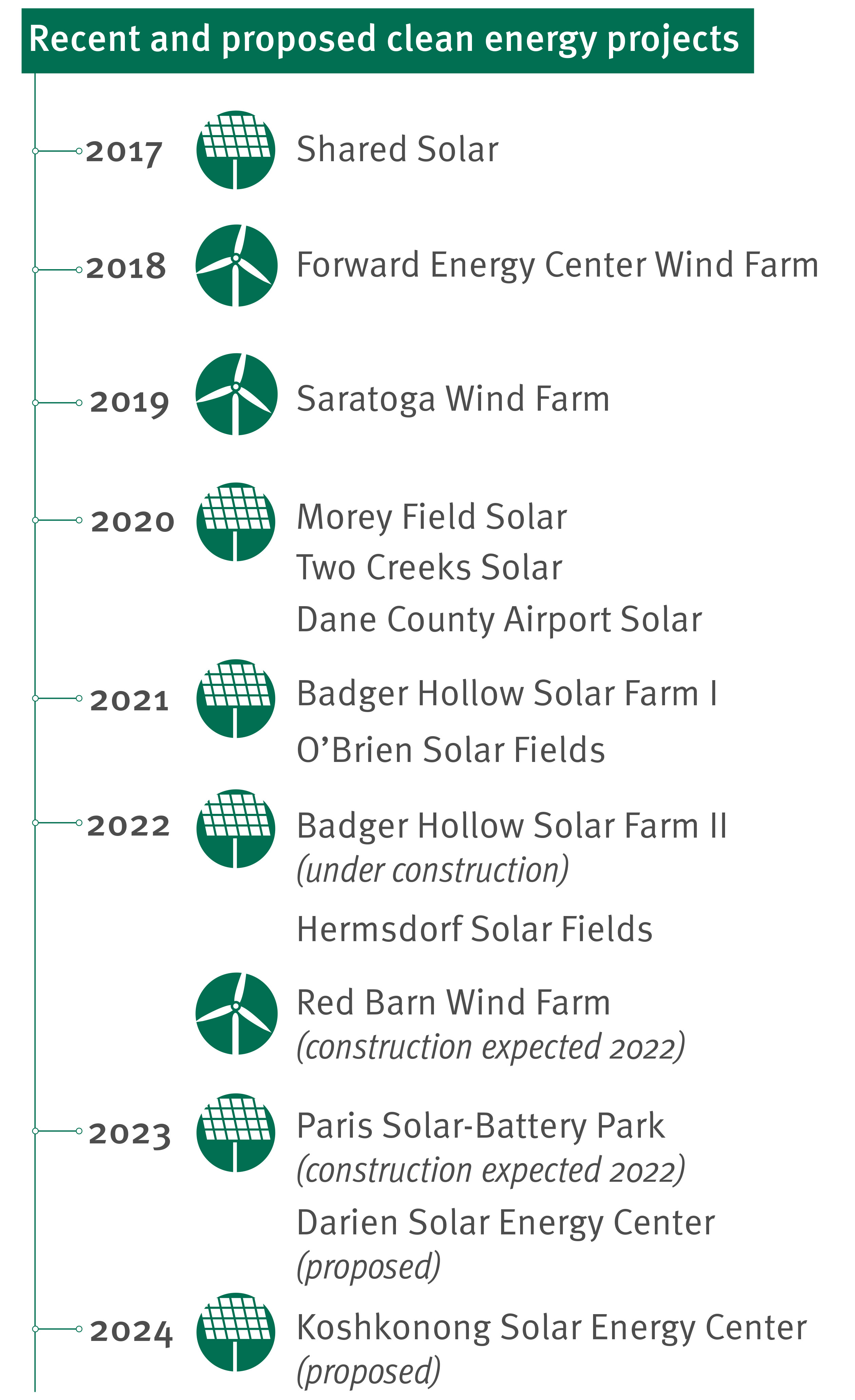

These renewable energy investments include the following proposed projects:

- Darien Solar Energy Center: If approved by regulators, MGE will own 25 megawatts (MW) of solar energy and 7.5 MW of battery storage from the 250-MW solar park to be built in the Town of Bradford in Rock County and the Town of Darien in Walworth County.

- Koshkonong Solar Energy Center: If approved, MGE will own 30 MW of solar energy and 16.5 MW of battery storage from the facility to be located in the Towns of Christiana and Deerfield in Dane County.

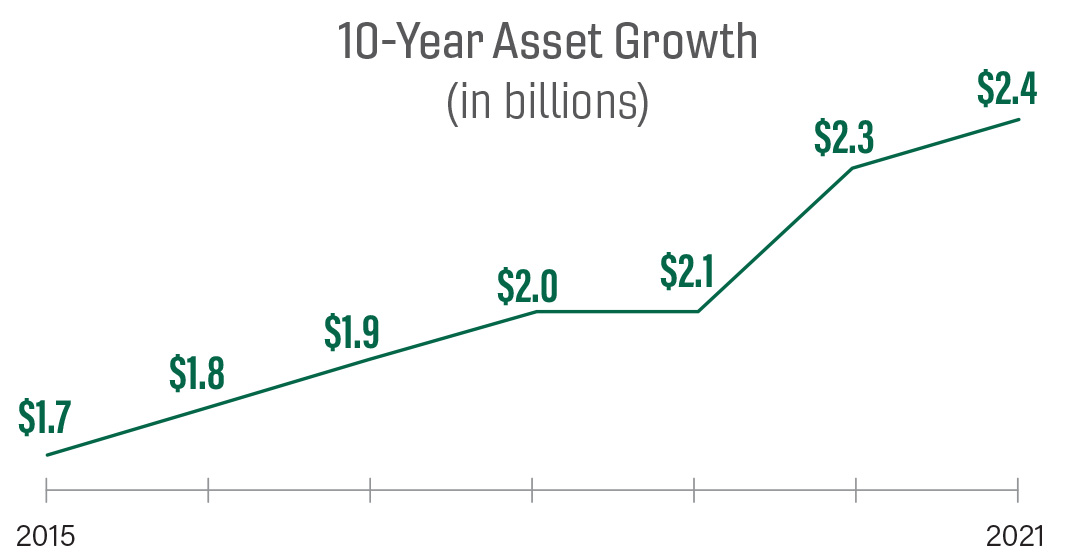

MGE continues to receive from Standard & Poor’s and Moody’s the highest credit ratings in the nation for investor-owned, combination utilities. The company’s recent clean energy investments, combined with its longstanding, strong financial profile, have allowed MGE Energy to continue its steady asset growth. Since 2015, the company has grown its asset base from approximately $1.7 billion to approximately $2.4 billion.

Financial strength to build value, power a cleaner future

Total return is a measure of your investment’s performance. It is the combination of stock price appreciation and reinvested dividends.

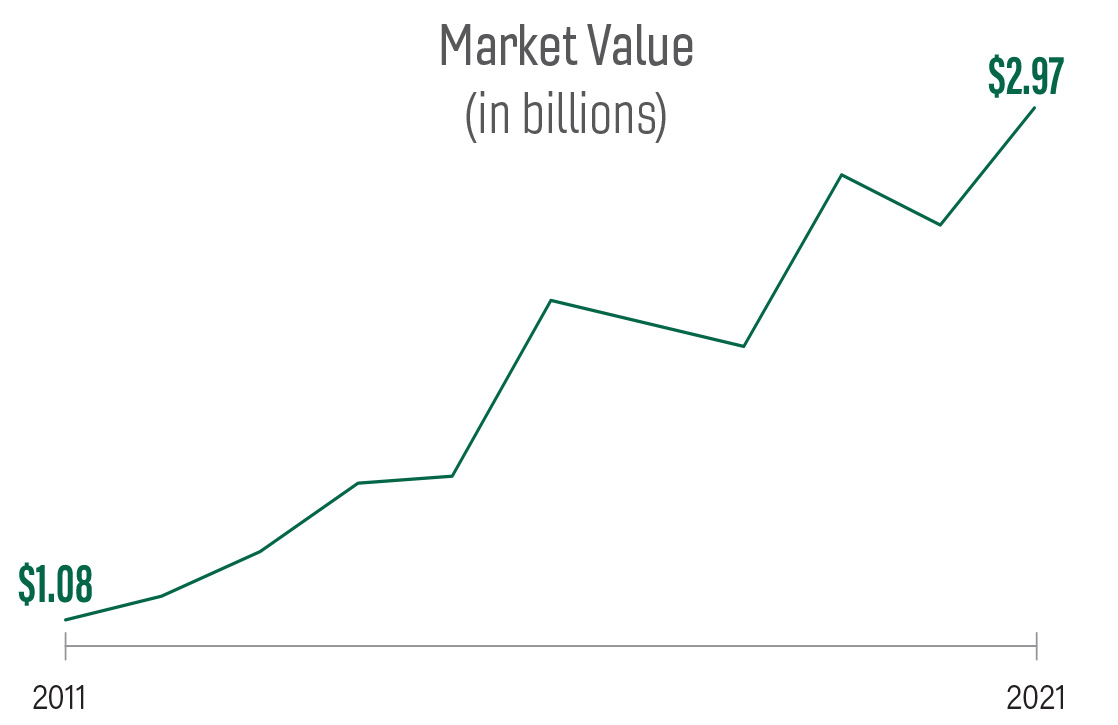

For the 10 years ending with 2021, MGE Energy’s annualized total return was almost 13%. If you invested $1,000 in 2011, your investment would have grown to $3,364 by the end of last year.

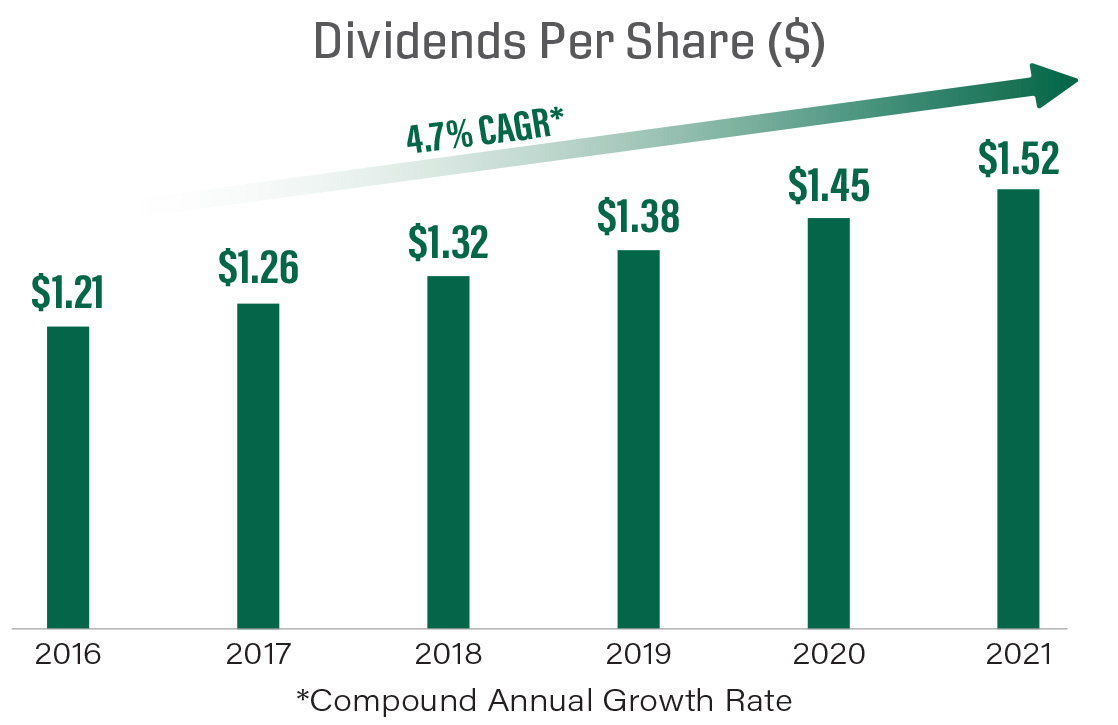

Your Board of Directors increased the annual dividends paid per share by about 5% in 2021. Our annual dividends paid per share reached $1.52. For the last five years, MGE Energy shareholders have seen a compound annual growth rate in dividends of nearly 5%. MGE Energy has paid dividends for more than 110 years and increased the dividend for 46 consecutive years.

In 2021, MGE Energy’s market value reached almost $3 billion, nearly triple its value 10 years ago. Market value is determined by multiplying the number of shares outstanding by the closing stock price per share. MGE Energy is committed to building shareholder and customer value with disciplined financial management and with cost-effective investments to advance sustainability and new programs, products and services to meet customer needs and expectations.

MGE's smart thermostat program expanding

Under our Energy 2030 framework for a more sustainable future, MGE committed to working with customers to advance new technologies to manage our collective use of energy which, in turn, helps to manage demand on our distribution grid and long-term costs. Our customer programs provide value while helping to meet customers’ evolving needs and preferences and our shared sustainability goals.

One such program is MGE’s demand response smart thermostat program, MGE Connect®. Originally launched in 2019, the program is undergoing a second expansion to serve up to 4,000 customers in 2022.

MGE Connect helps MGE better understand the potential for reducing electric peaks using smart technologies. It also helps customers reduce their carbon footprint while earning rewards from MGE.

About MGE Connect

MGE Connect®, the company’s smart thermostat program for residential customers, is one way MGE is using new technologies to help manage our collective use of energy, a foundational objective under MGE’s Energy 2030 framework. It also is an example of how MGE, as conductor of the electric grid, is adding value to the grid for the benefit of customers, individually and collectively.

Electric use peaks during stretches of hot, humid days when air conditioners run in a majority of homes and businesses. This puts pressure on the electric grid and generation resources. With customers’ permission, minor temperature adjustments are made to their smart thermostats to reduce energy use during periods of high demand.

Nearly 2,500 households participated in MGE Connect during the 2021 season. Some of the events lowered demand by more than 2 MW each hour. This is equal to the power from 6,000 solar panels or generating enough electricity to offset the usage of about 550 MGE households in the summer.

Energy efficiency is a key strategy for reducing carbon dioxide emissions and achieving net-zero carbon electricity by 2050. Learn more about MGE Connect.

New wind, solar and battery-storage projects moving forward

As part of MGE’s ongoing transition toward greater use of renewable energy, the company’s 8-MW Hermsdorf Solar Fields project in southeast Madison came online in spring 2022 to serve the City of Madison and the Madison Metropolitan School District.

State regulators have approved MGE’s planned purchase of 20 MW of solar energy and 11 MW of battery storage from the Paris Solar-Battery Park, a 200-MW solar and 110-MW battery-storage facility to be built in Kenosha County, Wis.

“The Paris Solar-Battery Park continues the progress we’ve already made increasing renewable energy, reducing carbon emissions and advancing new technologies to benefit all our customers,” said Jeff Keebler, MGE Chairman, President and CEO. “MGE’s first addition of utility-scale battery storage is a new and important technology to help us reach our sustainable energy goals.”

MGE’s share of the output will power about 6,000 households. The project is expected to begin serving customers in 2023.

Red Barn Wind Farm

From 2015 through 2024, MGE estimates the addition of nearly 400 MW of wind, solar and battery storage. The company expects to invest in additional renewable generation beyond what is currently planned.

Three years after MGE’s 66-MW Saratoga Wind Farm came online, the company has gained approval to grow its wind capacity further with the planned purchase of part of the Red Barn Wind Farm. MGE will own about 10% of the 92-MW wind farm to be built this year in Grant County, Wis. Red Barn’s 28 turbines are expected online by the end of the year. MGE’s share of the project will power about 4,000 households.

Transition from coal

These investments, combined with MGE’s other recent and proposed clean energy projects, will help to replace capacity lost with the upcoming retirement of the coal-fired 1,100-MW Columbia Energy Center. Unit 1 is expected to be retired by the end of 2023, with Unit 2 shortly thereafter, by 2025, which is about 15 years ahead of schedule.

With the retirement of Columbia and the planned transition of the 1,230-MW Elm Road Generating Station from coal to natural gas expected to begin within the next couple of years, MGE expects to reduce its current use of coal about 75% by 2025 and to eliminate its use of coal as an energy source by 2035. This transition and the company’s investments in renewable energy will help MGE advance its goals to reduce carbon emissions at least 80% by 2030 and to achieve net-zero carbon by 2050.

“In 2019, MGE was one of the first utilities in the nation to commit to net-zero carbon by 2050. Since announcing our carbon reduction goals, we have said that if we can move further faster by working with our customers, we will,” said Keebler. “We’re committed to doing everything we can do today to advance our deep decarbonization strategies as quickly and as cost-effectively as we can while maintaining our top-ranked electric reliability and our responsibility to those we serve.”

MGE proposes electric rate changes for 2023

On April 1, MGE filed to reopen specific items in its 2021 rate case, which was settled last year. When the company’s rate case was settled in 2021, MGE requested the opportunity to address 2023 electric rates for specific items, including generation assets, which include purchase power agreements, and any potential changes in the federal tax code. State regulators approved the limited reopener request.

The utility is requesting an overall increase of 4.38% in electric rates for 2023. If approved, residential customers would see a slightly lower increase of 3.81%. The typical residential customer, using 500 kilowatt-hours a month, would see a bill increase of about $3.54 a month. Bill impacts for non-residential customers vary by rate class.

These costs for 2023 reflect the costs of new MGE generation assets, including the:

- Badger Hollow Solar Farm. Phase two of the 300-MW solar generating facility is under construction. Phase one became operational in fall 2021.

- Paris Solar-Battery Park. MGE recently received approval to purchase 20 MW of solar energy and 11 MW of battery storage from the project expected online in 2023.

- Red Barn Wind Farm. MGE recently received approval to purchase about 10% of the output of the 92-MW wind farm expected to be built this year.

- West Riverside Energy Center. MGE is seeking approval to purchase up to 50 MW of this state-of-the-art natural gas plant currently operational in southern Wisconsin. Natural gas is a bridge fuel to provide reliability and dispatchability as the company continues to transition from coal and toward net-zero carbon electricity. Since West Riverside is an existing facility, MGE’s investment will not result in new carbon emissions.

Planning for retirement of Columbia Energy Center

MGE also is seeking regulatory approval to accelerate the depreciation schedule of Unit 2 of the coal-fired Columbia Energy Center and other plant assets. The current schedule calls for depreciating these assets until 2038. The reopener request revises the depreciation schedule for Unit 2 and shared equipment to 2029 to align with the depreciation schedule for Unit 1. Regulatory approval of the limited reopener is pending with a final order expected by the end of the year.

The retirement of Columbia about 15 years ahead of schedule helps to advance MGE’s goal of reducing carbon at least 80% by 2030 and our goal of net-zero carbon by 2050. By 2025, MGE expects to eliminate about 75% of the company’s current coal use. The company expects to eliminate coal as an energy source by 2035.

No proposed changes to gas rates

An overall increase in natural gas rates of 0.95% in 2023 was already approved by regulators in MGE’s 2021 rate case. The typical residential natural gas customer will see an increase of about $2.76 for the year in 2023. The increase reflects the cost of technology improvements and infrastructure costs to maintain a safe and dependable system.